Singer Bangladesh Ltd is set to launch the commercial operation of its new manufacturing plant by June this year, a move aimed at bolstering its foothold in the local market, as outlined in the company’s annual report for 2023.

“Our new plant is in line with the new priorities of Bangladesh as the country enhances self-reliance in meeting its needs,” said MHM Fairoz, managing director and CEO of Singer Bangladesh, in the annual report.

The emphasis on domestic manufacturing is evident, given the governments thrust on ease of doing business and focus on “Made in Bangladesh” products, he said.

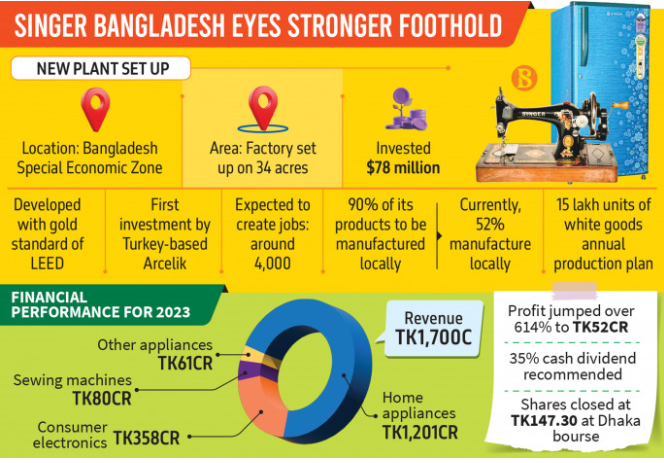

The chief executive office further said it is also the first investment in the country by Arcelik – the flagship company of the Turkey-based Koç Group. Arcelik acquired Singer Bangladesh in 2019.

“I look forward to updating you on our new plant as we come closer to commencing operations,” he added.

The multinational electronics and home appliance firm has commenced construction of the new plant adhering to the gold standards of LEED – a globally recognised green building certification – investing $78 million, or around Tk800 crore, at the Bangladesh Special Economic Zone in Narayanganj’s Araihazar in 2022.

Set up on the 1.35 lakh square metre industrial plot, the initial capacity of the factory would be 15 lakh units of refrigerators, televisions, washing machines, air conditioners and other major appliances annually, which will strengthen Singer’s position in the market, according to the company’s annual report.

The new factory will also create jobs for around 4,000 people.

Singer, which began with sewing machines and eventually turned into the largest household name for home appliances and televisions in the country, lost momentum in the race in the 2010s, while the great localisation wave made Walton the largest player in the refrigerator and television market.

According to a UCB Asset Management report, Singer is competing with Walton as the second largest brand, with a 12% market share in refrigerators and 11% in television sets, against Walton’s gigantic 72% and 27% market shares in the two categories, respectively.

With a 13% market share, Singer is lagging only behind General and Gree in air conditioners, and with an 18% market share, it is trying to catch up with Samsung in the washing machine market.

Defying industry-wide challenges and de-growth trends, Singer Bangladesh has reported a remarkable 615% growth in profits for 2023.

After releasing the audited results, the company declared a 35% cash dividend for shareholders in 2023.

It had paid a 10% cash dividend in 2022.

The audited results revealed a noteworthy surge in profit after tax, soaring from Tk7 crore in 2022 to Tk52 crore in 2023. Earnings per share rose from Tk0.73 to Tk5.24 in 2023.

But the financial challenges dragged down its revenue to Tk1,705 crore last year, compared to the previous year.

Singer Bangladesh shares closed at Tk147.30 on Thursday at the Dhaka Stock Exchange.

source: tbsnews.net

singer bangladesh ipo new plant