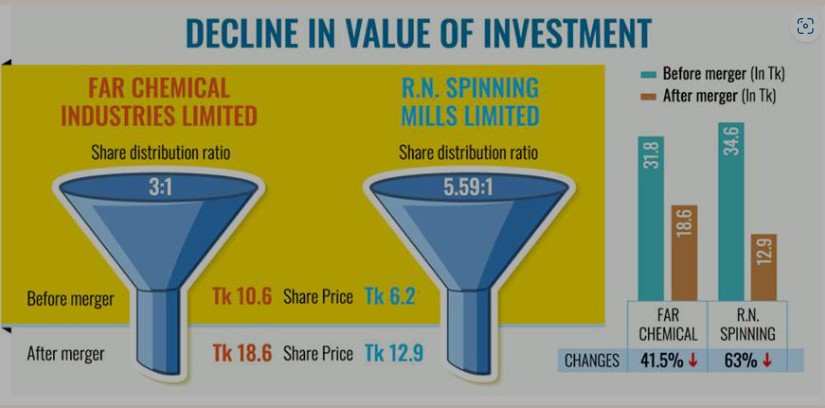

Investors of R.N. Spinning Mills and Far Chemical Industries have seen the value of their assets diminish in the last seven months after the listed companies merged with non-listed sister concerns.

A Tk 100 investment in R.N. Spinning Mills has eroded to around Tk 37 only on the Dhaka Stock Exchange (DSE) by Thursday since the listed company merged with non-listed Samin Food and Beverage inds and Textile Mills. Hence, the assets’ worth has been reduced by nearly 63 per cent during the period.

Similarly, investors of Far Chemicals lost 41.5 per cent of their assets’ value after the merger with non-listed S.F. Textile Industries.

Both FAR Chemical and R.N. Spinning Mills are owned by the same group of people. The companies’ boards came up with the amalgamation plan after the organisations had endured persistent losses for years.

Pre-merger Far Chemical that produced textile dyeing products was in the red for three consecutive financial years to FY23. Its cumulative losses amounted to Tk 362 million.

RN Spinning reported losses since a fire incident led to the shutdown of the factory in April 2019. Its negative earnings aggregated to Tk 6.55 billion in the five years through June this year.

A merger is aimed at gaining market share, reducing cost of operations, expanding to new territories, growing revenue, and increasing profits. But the mergers of R.N. Spinning with Samin Food and Far Chemical with S.F. Textile are yet to bring any good news for investors.

Before the merger, Far Chemical was Tk 10.6 per share. Every investor got only one post-merger share for each 3 pre-merger shares of Far Chemical.

If an investor had 300 pre-merger shares, his/her assets’ worth fell from Tk 3,180 to Tk 1,860, with the number of shares reduced to 100 and the stock being traded at Tk 18.6 per share on Thursday.

A similar scenario emerged in the case of R.N. Spinning Mills too. Before the merger, the share price of R.N. Spinning was Tk 6.2 each on the DSE. Every investor got only one post-merger share for each 5.59 pre-merger shares.

Hence, an investor’s 200 pre-merger shares were converted into only 35 post-merger shares. So, the assets’ worth plunged from Tk 1,240 to Tk 451.5 by Thursday. The stock closed at Tk 12.9 per share last week.

Post-merger financial performance

Though R.N. Spinning had negative earnings before the merger, the company in the latest disclosure declared consolidated earnings of the entities that combined into one. Still, their combined financial outcome decreased when compared with the pre-merger scenario.

The consolidated earnings per share plummeted to Tk 0.09 in the nine months to March this year from Tk 0.34 a year ago, as reported by the company referring to un-audited financial results.

The company’s price-to-earnings ratio, which measures the stock price relative to earnings per share, is 107, much higher than the textile sector’s PE ratio of 15.07.

On the other hand, Far Chemical Industries showed a sign of recovery in the nine months to March this year, according to the company’s earnings disclosure.

The EPS was Tk 0.26 for the period, which was Tk 0.54 in the negative a year earlier.

Far Chemical’s P/E ratio, according to the un-audited financial statement, is 53.65, higher than the overall P/E ratio of 14.67 of the pharmaceuticals & chemicals sector.

Talking to the FE, several asset managers said they were skeptical about the post-merger earnings results of the companies that belong to the FAR Group.

The chairman of the conglomerate is Abdul Kader Faruk who had been accused of siphoning money from the IPO fund of Ring Shine Textiles, according to an inquiry report of the securities regulator.

The asset managers said positive earnings might be fictitious and intended to drive the stock price up on the bourses to the benefit of sponsor-directors.