Stocks failed to sustain the revival spirit as rising interest rates and approval of a big amount of zero coupon bonds turned investor sentiment against the market.

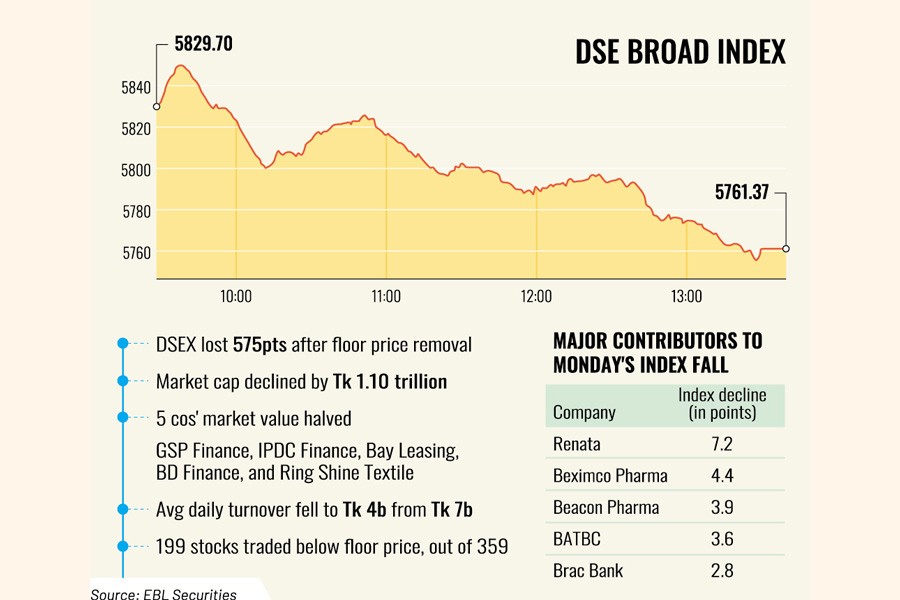

Substantial price erosion of large-cap stocks dragged the Dhaka Stock Exchange (DSE) down by 68.32 points to 5,761, the lowest in three years since May 2021.

The maximum lending rate jumped to 13.55 per cent for April as SMART (six-months moving average rate of Treasury bills) rose to 10.55 per cent from 9.61 per cent the month before.

With the interest rate soaring, the central bank reduced the lending margin for banks to 3 per cent from 3.50 per cent on Sunday. Yet, the maximum lending rate has gone higher for the current month.

Generally, the market tends to weaken when interest rates rise and funds are diverted to the money market from the capital market.

The market pulse shifted to correction mode after a short-lived optimism as investor confidence waned, said market experts.

Renata, Beximco Pharma, Beacon Pharma, BAT Bangladesh, and BRAC Bank contributed largely to Monday’s market plunge. They jointly accounted for one-third of the day’s index decline.

The index lost 575 points or 9 per cent since the withdrawal of floor price on January 18. The overall market lost Tk 1.10 trillion in asset value during the time.

Rising interest rate is one of the major factors behind the downturn of the country’s stock market,

said Md Sajedul Islam, managing director of Shyamol Equity Management.

Moreover, the Sunday’s regulatory approval of a large amount of zero coupon bonds to be issued by Beximco and pre-Eid sale pressure exerted a downward pressure on the index, he said.

Beximco will issue bonds to collect Tk 15 billion at a time when the stock market has been suffering from a liquidity shortage.

“Right now, the market hardly has the capacity to absorb bonds of such a big amount,” said a merchant banker, requesting anonymity.

Amid the tightening of the money market, the issuance of the bonds will worsen the liquidity condition of the stock market.

On the other hand, the rising interest rate of Treasury bills and bonds is driving up the cost of deposit for banks. Now, banks have to offer higher rates to attract savers.

“The growing deposit rates in the banking sector and the higher return from Treasury bonds are making savers to move funds to the money market from the stock market,” said Mr Islam.

Earlier, Sreepur Township project, the same project where Beximco will invest its bond money, raised Tk 10 billion through bonds, with IFIC Bank serving as its guarantor.

In 2021, Beximco floated Shariah-compliant sukuk bonds worth Tk 30 billion for five years to finance its two solar power plants and textile division’s green expansion.

Banks invested a huge amount of their funds into Beximco sukuk, instead of stocks after the central bank relaxed rules for the lenders to buy private sector-issued green sukuk.

Beximco turned out to be the ultimate beneficiary of the scheme as most banks subscribed to its Green Sukuk Al Istisna’a, thanks to the liberty extended by the Bangladesh Bank to the lenders.

On Monday, two other indices also ended lower. The DSE 30 index, comprising blue chips, slumped nearly 14 points to finish at 2,007 and the DSE Shariah index (DSES) shed 15 points to 1,251.

Turnover, a crucial indicator of the market, was Tk 4.69 billion on Monday, up from Tk 4.67 billion the day before.

More than 79 per cent traded shares saw price decline, as out of 397 issues traded, 315 declined, 47 advanced, and 35 remained unchanged on the DSE trading floor.

Panicked investors sold off major sector stocks, with the non-bank financial institutions experiencing the highest loss of 2.35 per cent, followed by pharmaceutical, telecom, food, engineering, banking and power sectors.

Low-performing stocks dominated the turnover chart with Shinepukur Ceramic becoming the most-traded stock, with shares worth Tk 325 million changing hands, followed by Central Pharmaceuticals, Fu-Wang Ceramic, Asiatic Laboratories, and Malek Spinning Mills.

Mercantile Insurance was the day’s top gainer, posting a 4.98 per cent rise while Emerald Oil Industries was the worst loser, losing 9.82 per cent.

The Chittagong Stock Exchange returned to the losing streak with its All Shares Price Index (CASPI) shedding 117 points to 16,511 and the Selective Categories Index (CSCX) losing 72 points to 9,926.

Source: thefinancialexpress