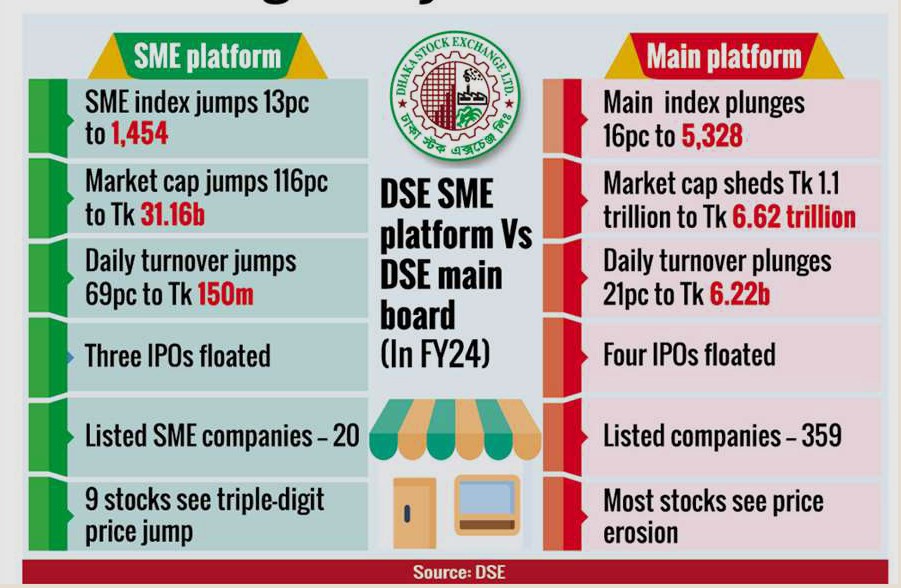

The SME market index soared almost 13 per cent year-on-year in the just concluded financial year as it drew a significant number of investors at a time when the main market endured persistent price erosion.

Substantial price hikes of most SME stocks in the absence of floor price and inclusion of new companies helped the SME board index soar by 163 points to 1,454 in FY24.

On the other hand, the benchmark index of the Dhaka Stock Exchange’s main market lost 1016 points, or 16 per cent, to 5,328 in the fiscal year that ended on Sunday against the backdrop of dwindling investor confidence. The main market was in a floor-price trap for more than seven months of the year. Large-cap stocks witnessed a sharp decline in market value in the year after the withdrawal of the price restriction.

“There is a correlation between the performance of the main market and the SME market; what we observed in the past three to four years,” said Md Ashequr Rahman, managing director of Midway Securities.

When the main market index and turnover went down, the SME market climbed up as some investors channeled funds to the SME market from the main market, he explained. Presently, investors are diverting funds to government securities for higher return.

When stocks in the main market are deemed undervalued investors will return to the main market, added Mr Rahman.

Stocks in the main market already lost Tk 1.1 trillion in market value to Tk 6.62 trillion, while the SME market value more than doubled to Tk 31.42 billion.

“Initial public offerings (IPO) along with floating of new shares and more investors [showing interest in the SME stocks] also helped the SME market stay vibrant.”

The daily average turnover in the main market plunged 21 per cent year-on-year to Tk 6.22 billion in FY24, thanks to price restriction, while the SME market turnover jumped 69 per cent to Tk 150 million in FY24 from the year before.

Three new SME companies — Agro Organica, Web Coats, and Craftsman Footwear and Accessories — got listed in the SME market in the year ended in June, taking the total number of SME stocks to 20.

These newly-listed securities saw a remarkable price surge of 143 per cent to 249 per cent since listing as opportunist investors chased these stocks in anticipation of quick gains.

Half of the SME stocks saw triple-digit price jumps as eligible investors joined the rallies in their hordes when the main market remained unattractive for long owing to floor price.

What was more surprising was that little-known Yusuf Flour exhibited abnormal price hike in the year, becoming the most-expensive stock on the exchanges, leaving many well-performing stocks behind.

Yusuf Flour escalated 512 per cent on the DSE SME board in the just-concluded financial year to Tk 6,351.9 per share.

The rapid price surge took Yusuf Flour’s market value to Tk 3.85 billion whereas its paid-up capital was a mere Tk 6.07 million.

Another SME stock, Himardi also jumped 236 per cent to Tk 2,245 per share in the year to June 30, becoming the fifth-most expensive stock.

The market value of Himadri, which runs six potato cold storage units in the northern part of Bangladesh and is a subsidiary of Ejab Group, climbed to Tk 5.6 billion whereas the paid-up capital was only 25.25 million.

Although Yusuf Flour and Himadri gained value at a remarkably fast pace, the number of trades and trade volume entailed was insignificant. Analysts fear that gambling acted as a short-term catalyst.

The listed SMEs have floated a small number of shares. So, when speculations do the rounds that a stock would continue going up, buying pressure even from a small group of general investors eventually helps the stock move up quickly on the bourses.

“The SME stocks have low paid-up capital, and a small number of shares, which makes it easy for gamblers to manipulate the price,” said Prof Abu Ahmed, a former chairman of the economics department of the University of Dhaka.

The trading pattern of some SME stocks looks unusual, he said, adding that without manipulation the kind of price jump was not possible.

Investors need to be cautious while putting money in such speculative stocks, Prof Ahmed added.