Over 22pc year-on-year public debt increase totals Tk 16.59t last Dec

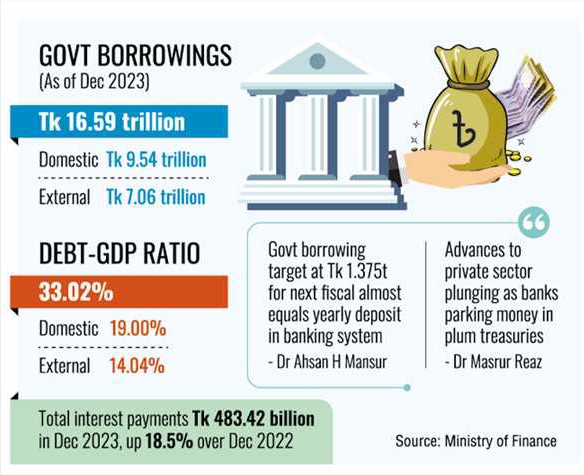

Growing government borrowing, totalling Tk 16.59 trillion as of last December, took the debt-to-GDP ratio to 33.2 per cent, according to official statistics.

The ratio, though going up constantly, was significantly lower than the IMF threshold of 55 per cent.

The aggregate public-debt buildup as in December 2023 accounts for over 22- percent increase year on year.

A latest bulletin of the Ministry of Finance (MoF) shows the figures, giving economists to believe that such debt situation may create imbalances in public finance, besides creating crowding-out effect in the economy.

However, this debt volume is purely government borrowing, not inclusive of private-sector borrowing.

According to the MoF report, most of the domestic borrowings are coming from the banking system through lucrative instruments like state treasury bills and bonds in what appears to be a paradigm shift on the money market.

The data issued by the finance division of the MoF reveal that the government heavily relied on domestic borrowing to bridge the gap between its high spending and low revenue earning.

Its domestic borrowings stood at Tk 9.54 trillion at the end of December 2023 while the external debt worth Tk 7.06 trillion.

Total debt-to-GDP (gross domestic product) ratio stood at 33.02 per cent, as of December 2023 by official count. And domestic debt-GDP ratio was 19.0 per cent while external debt-GDP ratio at 14.04 per cent.

The debts claim hefty interest payments per annum, apart from repayment of the principal, with strains on the public exchequer. Interest payments were recorded Tk 483.42 billion at the end of last December or up by 18.5 per cent or Tk 75.5 billion from the same period a year before.

The MoF in its report says total debt-to-GDP ratio was 33.02 per cent based on the GDP projection for FY2024 by BBS which is “significantly lower than the IMF threshold of 55 per cent”.

But it notes that the gap between the debt from the banking sources and that from the nonbanking sources has been on the increase.

Debt from banking sources stood at Tk 5.25 trillion at the end of December 2023, up nearly 20 per cent year-on-year.

On the other hand, the government debts from nonbanks increased less than 1.0 per cent during the period under review.

Economists say the IMF threshold of 55 per cent in terms of GSDP is one measure but revenue-to-GDP proportion matters more.

They note that Bangladesh’s tax revenue remained much lower than its aggregate revenue collection and it may create problem in debt servicing.

Bangladesh’s revenue, including foreign grants, was Tk 3.69 trillion in actual terms in 2022-23.

“We earn much less. How will we pay!” wonders Dr Ahsan H. Mansur, executive director of the Policy Research Institute of Bangladesh or PRI.

He points out that Bangladesh’s financial market is also much smaller. And the total government borrowing is almost similar to that of the total deposits in the country’s banking system.

“Our space for borrowing is much small,” the economist told the FE about possible oversaturation of the credit market.

Mentioning that the government has the target of borrowing Tk 1.375 trillion for the next fiscal year from the banking system, he said: “This volume is also similar to that of the yearly deposit growth in the banking system.”

Dr M. Masrur Reaz, Chairman and CEO of the Policy Exchange Bangladesh, says an unprecedented increase in debt service due to extensive borrowings has created serious imbalances in the public finances, leading to a rise in government spending on interest payments.

He notes that heavy borrowing through treasury bills and bonds shows “banks parking their money in risk-free high-yielding government papers. As a result, bank advances to the private sector are plunging.”

However, reform initiatives, such as online issuance process, rationalised investment limits and the introduction of multi-tier interest rates along with inflation contributed to the reduction in the net sales of the national savings certificates or NSC instruments.

The total outstanding from the NSC was Tk 3.59 trillion, down by Tk 32.86 billion from the same period a year earlier.