Al-Amin Chemicals Industries, having raised Tk25 crore by issuing fresh shares without prior consent from the Bangladesh Securities and Exchange Commission (BSEC), now wants post-facto approval.

The chemical products manufacturer has recently written to the commission requesting post-facto approval for the increased paid-up capital.

Al-Amin Chemicals, which got listed in the capital market in 2002, has been lying around in the over-the-counter (OTC) market since 2009 owing to several irregularities.

The company had applied to the Dhaka Stock Exchange (DSE) for relisting on the SME platform.

But owing to all the irregularities and also no consent from the BSEC, the DSE rejected the company’s application.

The chemical firm’s Managing Director Munshi Shofiuddin told The Business Standard, “We are now seeking post-facto approval for the paid-up capital.”

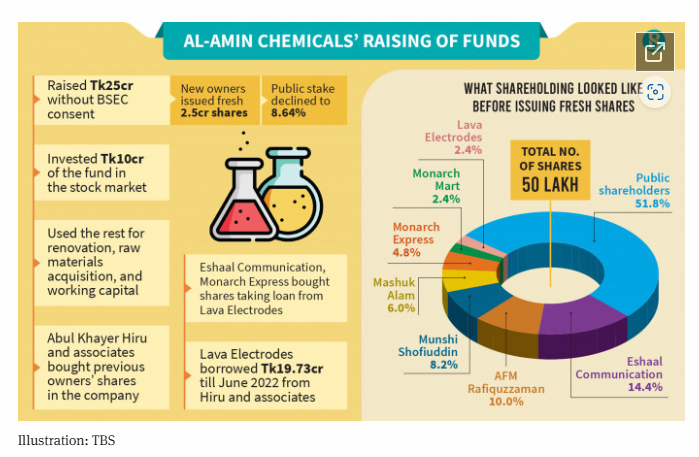

He added, “We raised capital of Tk25 crore through private placement to some investors. A portion has been invested in the company for renovation, raw materials acquisition, and working capital. Around Tk10 crore has been invested in the stock market.”

In October this year, the DSE carried out an inspection at Al-Amin Chemicals and uncovered some anomalies.

According to the inspection report, which was submitted to the BSEC, the company’s new owners raised capital without the regulator’s consent, and issued shares in favour of shell or shadow firms.

Also, the new owners altered the investment plan of utilising the fund, and their new strategic business plan does not support the company’s present performance.

Therefore, the DSE expressed concerns about the company’s efforts to protect the interest of investors and its contribution to developing a sustainable capital market.

The new owners issued 2.5 crore fresh shares at Tk10 each. The company’s shares last traded at Tk31 each at the DSE on 30 November.

The free-float shares now stand at 8.64%, which was 51.82% before the issuance of new shares.

More focus on stocks, less on core business

According to the DSE inspection report, Al-Amin Chemicals was supposed to invest Tk5 crore of the raised fund in the capital market. Instead, the company invested Tk10.28 crore in the stock market and took a margin loan of Tk4.63 crore. So, the total value of investment in the stock market stood at Tk14.16 crore.

Till 12 October 2023, its unrealised loss stood at Tk75 lakh owing to the downturn of the stock market.

When questioned, Munshi Shofiuddin said, “We invested more funds than our plan because we cannot keep the fund idle. Stock prices in the market are now at the bottom line, so we think we will get good returns in future.”

Share issuance in favour of shell or shadow firms

The DSE inspection team found that Al-Amin Chemicals issued new shares to three corporate shareholders who have no visible operation since their incorporation.

Eshaal Communication Limited, represented by Aminul Islam Sikder and Md Khirul Bashar, held 32.4% shares of Al-Amin Chemicals.

The company was incorporated in 2002 and has no revenue for 2022. Its retained earnings as on 30 June 2022 is Tk15 lakh.

Lava Electrodes, which was formed in 2016 and has retained earnings of Tk72 lakh as on 30 June 2022, owns 5.4% shares.

Monarch Mart Limited, incorporated in 2022, owns 10.8% shares of Al-Amin Chemicals. Monarch Mart’s revenue and retained earnings in 2022 stood at Tk7.82 crore.

The report said Eshaal Communication and Monarch Express invested in Al-Amin Chemicals by taking a loan from Lava Electrodes Industries Ltd.

The DSE team raised concern that Md Abul Khayer Hiru, his wife Kazi Sadia Hasan and their associates are the lenders of Lava Electrodes.

Lava Electrodes borrowed Tk19.73 crore till 30 June 2022.

The DSE found that the present business situation of Al-Amin Chemicals does not reflect its strategic business plan regarding products manufacturing and revenue earnings.

Munshi Shofiuddin said, “We provided the company’s business plan to the commission. Because of difficulties in opening letters of credit (LCs), and the economic crisis, we did not fulfil the plan. We hope we can fulfil the plan very soon. Our revenue is growing, and profit will increase.”

source: tbsnews.net

al amin chemicals fresh shares otc