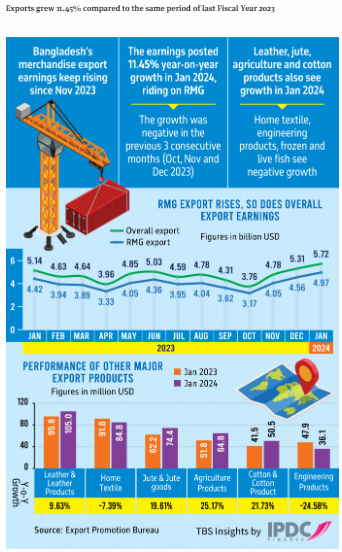

Bangladesh’s merchandise export earnings reached $5.72 billion in January, highest in a single month so far, bringing another good news on the external sector in the first week of this month after monthly remittance hit seven-month peak.

Apparel export receipts increased by 12.45% to $4.97 billion in January, putting total exports to $33.26 billion in the first seven months of the current fiscal year. The amount is 2.52% more compared to a year-ago period, according to figures released by the Export Promotion Bureau (EPB) on Sunday.

The previous record for the highest single-month export receipts was $5.37 billion in December 2022.

Inward remittance surged 7.69% year-on-year to $2.10 billion in January, Bangladesh Bank data said on Thursday.

Exporters say shipments have reached new heights as western economies are stabilising. Most of these countries are not increasing their interest rates and are expecting a decline in inflation.

As usual, the readymade garment led the export growth, with knitwear posting a more robust growth than woven apparels in the July-January period of the current fiscal year.

Sectors such as leather and leather products, jute and jute goods, agriculture, footwear, and cotton products showed positive growth.

However, home textiles, engineering products, and frozen and live fish faced year-on-year negative growth.

During the period, the RMG export witnessed a 3.45% year-over-year growth to $28.36 billion. Of the amount, knitwear exports were $16.17 billion with 8.15% growth, and woven garments earned $12.18 billion with 2.20% growth.

Fazlee Shamim Ehsan, vice president of the Bangladesh Knitwear Manufacturers and Exporters Association, told TBS that there were additional shipments in January that were originally scheduled to be shipped in December. This delay was due to the Christmas holidays in some western countries.

Ehsan mentioned that they are currently exporting for the summer.

He also highlighted that countries belonging to the Organisation for Economic Co-operation and Development (OECD) are expected to witness a decline in inflation to 3.2%, along with a projected GDP growth of 1.2% in 2024.

These factors are anticipated to contribute to the growth of Bangladesh’s exports in the coming days.

Despite all the positive indicators, exporters fear they may lose their competitiveness in the coming days as the government has withdrawn cash incentives on most apparel items and slashed them for remaining items.

Dutch fashion brand G-Star Raw Regional Operations Manager Shafiur Rahman said this year summer sales have already started in March due to fluctuations in temperature in western countries.

He said those retailers who were experiencing negative growth last year will try to return to business, adding that the US economy will enjoy money circulation ahead of their national election there, which will also help boost business.

Shafiur hoped that the apparel exporters would get better orders in the second half of this year, which will be for the spring and summer of 2025.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), told TBS last week, “Most western buyers are enjoying very good sales since last November as their economies are going to be stable after a slowdown.”

“Apparel stores enjoyed good sales during some festive events across the western world, especially Black Friday, Christmas Day, Boxing Day, and Cyber Monday,” he said, adding the stores also cleared their previous inventory during the festivals.

“As a consequence of their sales growth in January, our export was better,” said the BGMEA president.

Referring to the drop in inflation in Europe and the US, he said, “Brands are expected to boost their apparel sourcing from Bangladesh, having successfully cleared their inventory over the past year. Some buyers are already in talks with our exporters to increase orders.”

He mentioned that when exporters are expecting a surge in apparel orders from global buyers starting in the second quarter of this year, the withdrawal of cash incentives will affect the businesses.

BGMEA Senior Vice President SM Mannan Kochi said Bangladesh’s apparel exports to the US and the EU have been struggling for the last couple of months, but new markets are doing well.

However, the government’s sudden decision to cut incentives for three major new markets will affect growth, he added.

He also mentioned that on Sunday, they had a meeting with the finance minister over the cash incentives. “We have requested the minister to restore the cash incentives for apparel, as about 70% of items went out of the benefits, which will make it difficult for factory owners to survive,” he said.

source: tbsnews.net

imports exports 5.72 billion Bangladesh merchandise exports earning