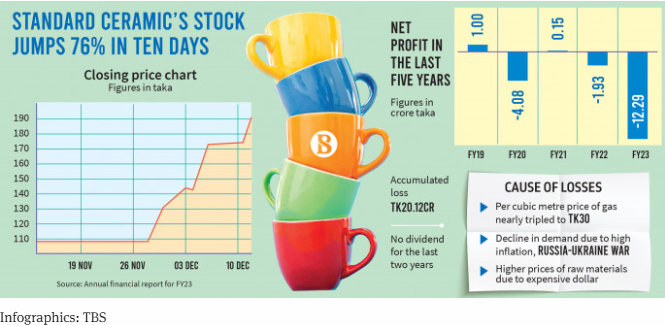

The tableware manufacturer’s share price jumped by 76% to Tk191.4 each on Tuesday, which was Tk108.7 on 28 November.

Against the backdrop of several challenges like the dollar crisis, high inflation and working capital shortage, the share price of Standard Ceramic Industries Ltd, a company that has been in losses for the last two fiscal years, have surged notably over the last ten trading sessions.

The tableware manufacturer’s share price jumped by 76% to Tk191.4 each on Tuesday, which was Tk108.7 on 28 November.

The company incurred back-to-back losses in the 2021-22 and 2022-23 fiscal years because of a significant drop in demand for its products as well as because of higher prices of gas and raw materials.

In FY23, its net loss stood at Tk12.29 crore, resulting in an accumulated loss of Tk20.12 crore. In FY22, it incurred a Tk1.93 crore loss. The company had last paid a dividend in FY21, that too, only 1% cash.

For its huge loss in FY23, the company blamed the cumulative effect of Covid-19, Russia-Ukraine war, high cost of imported raw materials which slowed down production and adversely impacted sales and profits.

Also, pricey gas and disruption in the supply of electricity also constrained production and sales, the company stated.

But amid all these factors, how the company’s share price, which had been at the floor since mid-August, suddenly shot up in ten days remains a mystery.

Standard Ceramic’s Company Secretary Jamal Uddin Bhuiyan could not be reached over phone for a comment in this regard.

The working capital shortage

In its qualified opinion and emphasis of matter, the auditor of Standard Ceramic said the company is suffering from a working capital shortage, which has increased its dependency on bank loans for deficit financing.

The accumulated loss has dragged down the firm’s equity to a negative Tk9.57 crore as on 30 June 2023.

According to the auditor, the firm’s current liabilities stood at Tk40.09 crore, which is 2.25 times of its current assets.

The increase in the company’s bank borrowings caused by its substantial operational loss is ultimately threatening the going concern of the company.

source: tbsnews.net

Loss-making Standard Ceramic’s skyrockets tableware manufacturer’s share price ipo