The state-owned telecommunications service provider Bangladesh Submarine Cable Company (BSCCL) will likely lose profits and market share in the coming days due to private companies gradually taking bigger slices of the pie.

The company’s market share has already been decreasing every year, according an equity note about the BSCCL by EBL Securities Ltd – a stockbroker firm.

The firm states that BSCCL is currently facing severe competition from the seven International Terrestrial Cable (ITC) operators in Bangladesh, and the company’s market share has slipped from 60 per cent in FY21 to 55 per cent in FY22, and 52 per cent in FY23.

Although bandwidth consumption is growing rapidly, BSCCL will face growing competition from ITC operators and three private submarine cable service providers after they begin their commercial operation, according to the EBL Securities equity note.

Seven International Terrestrial Cable (ITC) companies are currently operating in Bangladesh. The ITC license holders offer IPLC services by importing bandwidth from India. These companies are the main competitors of BSCCL in the international bandwidth market of the country.

The companies are – Fiber @ Home Ltd, Summit Communications Limited, Novocom Ltd, 1Asia Alliance Communications Ltd, BD Link Communication Ltd, Mango Teleservices Ltd, and Bangladesh Telecommunications Company Ltd.

Bangladesh Submarine Cable Company Ltd (BSCCL) is a core telecommunications service provider and international submarine cable operator in Bangladesh. It also operates as an International Internet Gateway (IIG) service provider.

Q1 of FY24

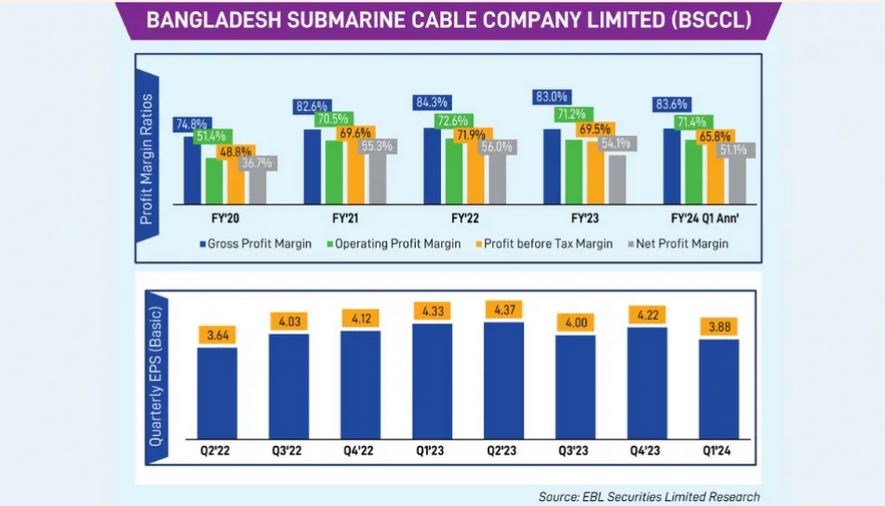

BSCCL posted a net profit of Tk 63.98 crore in the July-September period of 2023, compared to Tk 71.40 crore posted during the same timeframe last year, according to the company’s latest financial statement.

Its EPS stood at Tk 3.88 for July-September this year, whereas the figure was Tk 4.33 for the same period last year.

BSCCL Company Secretary Abdus Salam Khan said, “The EPS decreased mainly due to reduction of revenue in IP Transit service, and increase of financial costs, and provisions for bad and doubtful debts.

The company’s net operating cash flow per shares (NOCFPS) was Tk 5.23 for July-September 2023 as against Tk 6.04 for July-September 2022. Net asset value (NAV) per share was Tk 88.94 as on September 30, 2023 and Tk 85.05 as on June 30, 2023.

A BSCCL official said the NOCFPS decreased mainly due to less collection of revenue from the customers and increase of supplier’s payment and NAV has been increased mainly due to ordinary course of business activities.

Auditor opinion of FY23

The Bangladesh Submarine Cable Company Ltd (BSCCL) announced a record 51 per cent cash dividend for its shareholders for FY23 since its listing with the capital market. Its net profit in FY23 was Tk 279 crore, up 13 per cent from that in the previous year.

The company’s earnings per share (EPS) stood at Tk 15.19 for FY23, which was Tk 13.67 for FY22.

The auditor has stated that Tk 252 crore share capitals have been shown in BSCCL’s financial statement for FY23 without authorisation.

On September 3, after reviewing the company’s financial statement for FY23, the auditor mentioned that the state-owned telecommunications service provider was required to take prior approval from the government to show this figure on its financial statement, but it could not secure all the approvals yet.

A qualified opinion is a statement issued after an audit is completed by a professional auditor, suggesting that the financial information provided is limited in scope or the company has not maintained generally accepted accounting principles.

On Sunday, BSCCL shares closed at Tk 218.90 per share on the Dhaka Stock Exchange (DSE). With a market capitalisation of Tk 3,609 crore, the company’s paid-up capital is around Tk 165 crore. Listed in 2012, it belongs to the “A” category on the DSE.

The government held a 73.84 per cent stake in the company, while institutes owned 15.66 per cent, foreign 2.74 per cent and the public 7.75 per cent as on November, 2023.

Source: businesspostbd