Payments against claims of around 10 lakh policyholders are hanging in the balance as 29 life insurance companies are not clearing dues owing to a liquidity crisis, official figures showed.

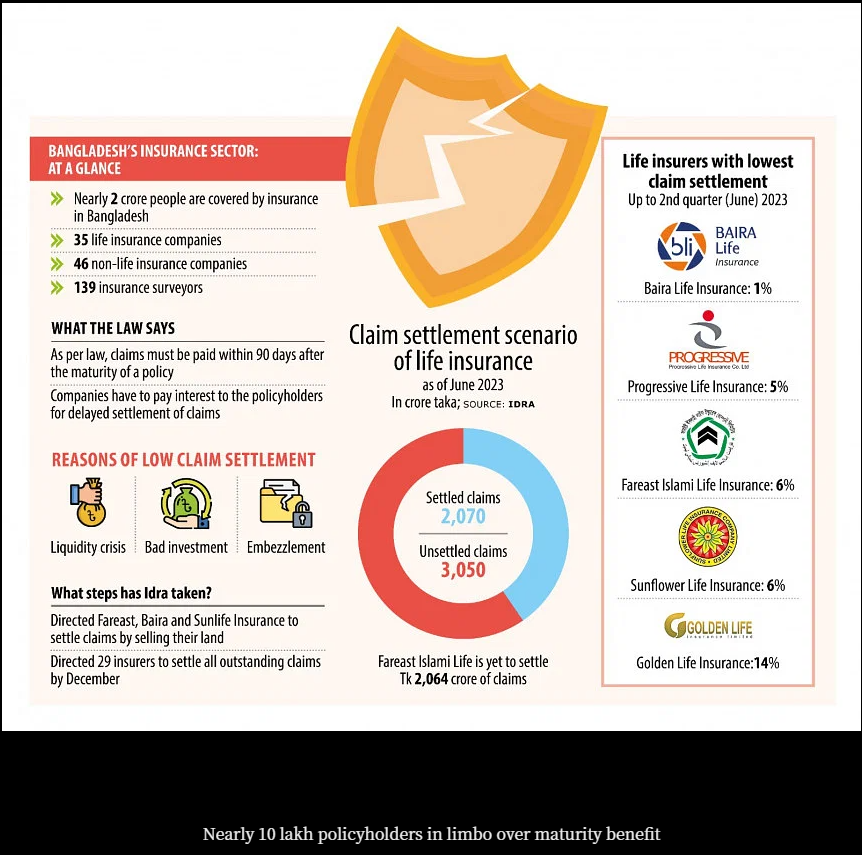

The unsettled claims involved Tk 3,050 crore in the four years to the second quarter of 2023, according to data from the Insurance Development and Regulatory Authority (Idra).

The companies settled claims worth Tk 2,070 crore during the period, which accounted for 40.42 percent of the claims made.

One of the policyholders who has not seen his claim settled is Rafiqul Islam, a resident of Uttar Saptana village in Lalmonirhat sadar upazila.

He opened a 10-year term policy with Fareast Islami Life Insurance Company in 2010. It matured in 2020.

Islam regularly visits the company’s local office since then in a bid to get Tk 110,000.

“Although my policy matured three years ago, I am still not getting the money,” the 55-year-old day labourer said forlornly.

He said he does not know whether he would get the money.

“When I opened the policy, I had thought that it would benefit me one day. Now I am disappointed. I made a mistake by opening the policy.”

As per the Insurance Act 2010, claims must be settled within 90 days of the submission of all papers to the company after a policy matures.

In a meeting on October 12, the Idra directed all the companies to settle the claims by December.

The regulator also directed Fareast Islami Life Insurance, Baira Life Insurance and Sunlife Insurance to make payments to the policyholders by selling land properties.

Of the 29 life insurers, Baira Life Insurance had the lowest settlement rate at 1 percent.

It was 5 percent for Progressive Life Insurance, 6 percent for Fareast Islami Life Insurance and Sunflower Life Insurance, and 14 percent for Golden Life Insurance, Idra data showed.

The unsettled amount at Fareast was Tk 2,064 crore. It made Tk 134 crore in payments against claims during the period.

Sheikh Kabir Hossain, chairman of Fareast, said the company is “sick” as it owes a lot of money while its owners are in jail.

He said new clients are not coming to open policies anymore as the company has gained a bad reputation, meaning there is a lack of incoming funds to clear debts.

Earlier, the company’s land and premises were put up for sale, but the properties could not be sold since potential buyers quoted lower than the purchased rate, he said.

According to an audit report, Tk 2,367 crore was embezzled from the company and accounting irregularities amounting to Tk 432 crore were also detected.

In September 2021, the Bangladesh Securities and Exchange Commission dissolved the company’s board. At present, a group of independent directors run Fareast Islami.

Progressive Life’s unsettled claims involved Tk 140.87 crore in the past four years. it settled claims of Tk 7.27 crore during the period.

Shajahan Azadi, managing director of Progressive Life Insurance, could not be reached for comments.

Ajit Chandra Aich, a former chief executive officer of the company, claimed that from 2008 to 2013, there were various irregularities in the company. Since then, the liability has been increasing day by day.

“In addition, the flow of new policy openings has fallen in the last few years. As a result, the income has decreased.”

Experts say if the claims of the policyholders are not settled quickly, it will send a bad message about the sector.

“Then it will be difficult for even good insurance companies to run and sustain business,” said Prof Md Main Uddin, a former chairman of the Department of Banking and Insurance at the University of Dhaka.

He said the Idra has instructed the three insurers to sell properties to clear dues. “It is a good move. However, the process of selling properties in such cases is quite long.”

The sector will not return to a good position if the government does not take any strict measures, he added.

AB Mirza Azizul Islam, a former finance adviser to the caretaker government, described the delay in claim settlements as unfortunate.

“As a result, people will lose confidence in keeping money with banks and non-banking financial institutions. Overall, the financial sector will receive a blow.”

Mohammad Zainul Bari, chairman of the Idra, said the companies that are not able to pay insurance claims on time all have one common problem: they do not have enough money in their life fund.

He said companies have wasted money in various ways, including spending more than the limit approved.

Some companies have invested in low-returning and risky sectors, so they are no longer able to make payments, said an official of the Idra.

Bari said some companies have committed irregularities in the name of investments. Some senior officials embezzled money and they are being prosecuted.

Companies have been instructed to pay insurance claims as soon as possible by reducing additional management costs, he added.

There are companies that have settled claims on time, including Alpha Islami Life Insurance, Chartered Life Insurance, LIC Bangladesh, Mercantile Life Insurance, and NRB Islamic Life Insurance.

Of them, Alpha Islami Life Insurance has paid all the claims, according to the Idra.

Nura Alam Siddikie Ovee, CEO of Alpha Islami, said claims are settled within seven days after policies mature.

“The good claim settlement ratio has broadened Alpha’s reputation and boosted the general public’s confidence in the company.”

Popular, Meghna, Pragati, Guardian, Sandhani, Rupali, Sonali, Protective Islami, Padma Islami, Trust Islami, Astha, and Akij Takaful Life Insurance have settled more than 90 percent of the claims during the four-year period.

MetLife, Delta Life and Best Life Insurance made payments against more than 80 percent of the claims they received.

An insurance company may have unsettled claims for a variety of reasons, such as claims submitted without necessary documents or require investigation, said Ala Ahmad, CEO of MetLife Bangladesh.

Jiban Bima Corporation’s settlement ratio was 69 percent, Prime Islami 69 percent, Zenith Islami 61 percent, and Jamuna Life 77 percent.

Currently, there are 35 life insurance companies and 46 non-life insurance companies in Bangladesh. The life insurance companies settled 85 percent of their claims in 2020, 58 percent in 2021 and 67 percent in 2022, according to the Idra.