Fifty-nine companies listed on the Dhaka Stock Exchange (DSE) may be downgraded to “Z” or junk category for non-payment of dividends and failure to hold annual general meetings despite the end of the financial year.

The companies are currently positioned in the “A” and “B” categories on the stock exchange, which is, experts say, sending the wrong message to the investors.

According to the settlement of transaction regulations of the stock exchanges as of Monday, these companies are in the criteria of downgrading to the Z category.

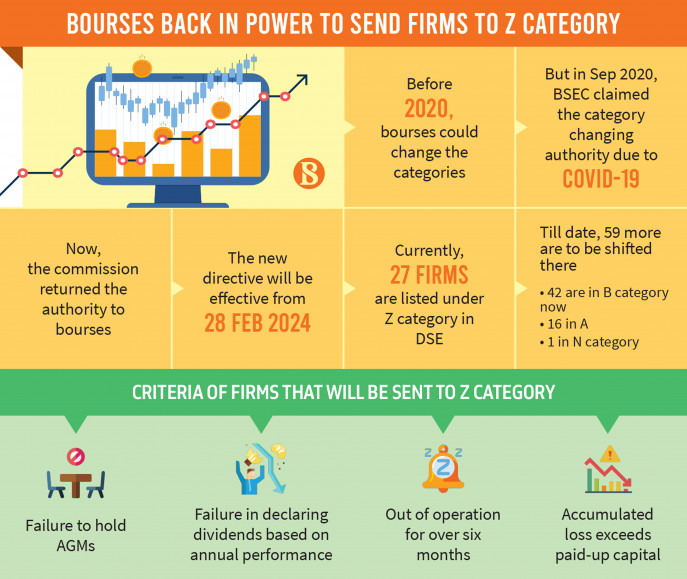

According to directives of the Bangladesh Securities and Exchange Commission (BSEC) issued on Monday, the companies that fail to meet the required criteria will be downgraded after 28 February of the upcoming year

Regarding taking a longer time to implement the new decision, BSEC Executive Director and spokesperson Mohammad Rezaul Karim told The Business Standard, “Category changes are closely linked to a company’s annual general meeting and dividends. During this time, some companies will try to maintain their category. Investors will also be able to make decisions based on this information.”

Category changes are closely linked to a company’s AGMs and dividends. During this time, some companies will try to maintain their category. Investors will also be able to make decisions based on this information.

The BSEC directive said no sponsor or director of a Z category company excluding bank, insurance company and non-bank financial institutions, shall be allowed to transect (buy, sell or transfer) any shares without prior approval of the commission.

Normally, if a listed company provides a dividend of more than 10 percent, it is listed in the A category, and if it provides less than that, it is listed in the B category.

However, a large proportion of 59 companies did not pay any dividend and some companies failed to hold annual meetings but their categories did not change from the current status in A and B categories.

The DSE could not change the categories as per a BSEC directive issued in September 2020 that barred bourses from taking such a decision.

In the context of the challenging business and profit scenarios during the Covid-19 pandemic, the commission decided to halt the downgrade to the Z category for companies even if they fail to meet the required criteria according to the settlement of transaction regulations.

The commission on Monday restored the power of the DSE and the Chittagong Stock Exchange to change the category of companies.

According to DSE officials, due to this new directive of the commission, 59 more companies are on course to be included in the Z category. Among them, 42 companies are currently in the B category, 16 in the A category, and one in a new or N category.

The exact number of companies could change between now and the implementation date, nearly three months from now, they said.

As per transaction settlement regulations, companies face downgrades to the Z category if they fail to hold their annual general meeting, do not declare dividends based on annual performance, cease operations continuously for more than six months and accumulate losses exceeding their paid-up capital.

Currently, there are 27 companies in the Z category.

Investors are not eligible to take margin loans to buy shares of those companies if they belong to Z category and the share trading is settled as per T+3.