The Dhaka Stock Exchange (DSE) – the country’s premier bourse – has had its accounts audited by the same firm for 36 years, a practice that experts believe compromises standards and undermines the fundamental principles of auditing.

At a meeting on Thursday, the DSE board decided to appoint a new auditor after the bourse’s newly appointed Managing Director ATM Tariquzzaman raised concerns about the current arrangement, according to sources at the DSE.

The decision is slated to be finalised at the annual general meeting on 21 December.

According to information from DSE, A Qasem & Co Chartered Accountants, has been auditing the bourse for more than three and a half decades.

According to the Companies Act, there is a provision for appointing a firm to audit a company’s accounts. For listed companies, a specific auditor can serve for three consecutive years, but no such restriction exists for non-listed companies.

However, Financial Reporting Council Chairman Md Hamid Ullah Bhuiyan is of the opinion that, on ethical grounds, a company should not be audited by the same firm for an extended period.

“If the same auditor continues to serve a company for an extended period, a strong relationship is established. While this may lead to the detection of minor irregularities, there is a risk that they could be overlooked due to the close auditor-company relationship, thereby compromising the auditor’s independence,” he expressed concern.

When informed that DSE has been audited by the same firm for 36 years, he said, “How is this possible? This is malpractice. While there may be no legal bar, the issue is a matter of principle.”

He questioned why the issue did not come to the notice of the Bangladesh Securities and Exchange Commission (BSEC) or anyone.

According to DSE sources, in Thursday’s meeting, Managing Director ATM Tariquzzaman pointed out his observation regarding the auditor appointment.

He said A Qasem & Co has a long-standing association with DSE, which is against the fundamental principle of an auditor’s independence.

The Dhaka Stock Exchange (DSE) – the country’s premier bourse – has had its accounts audited by the same firm for 36 years, a practice that experts believe compromises standards and undermines the fundamental principles of auditing.

At a meeting on Thursday, the DSE board decided to appoint a new auditor after the bourse’s newly appointed Managing Director ATM Tariquzzaman raised concerns about the current arrangement, according to sources at the DSE.

The decision is slated to be finalised at the annual general meeting on 21 December.

According to information from DSE, A Qasem & Co Chartered Accountants, has been auditing the bourse for more than three and a half decades.

According to the Companies Act, there is a provision for appointing a firm to audit a company’s accounts. For listed companies, a specific auditor can serve for three consecutive years, but no such restriction exists for non-listed companies.

However, Financial Reporting Council Chairman Md Hamid Ullah Bhuiyan is of the opinion that, on ethical grounds, a company should not be audited by the same firm for an extended period.

“If the same auditor continues to serve a company for an extended period, a strong relationship is established. While this may lead to the detection of minor irregularities, there is a risk that they could be overlooked due to the close auditor-company relationship, thereby compromising the auditor’s independence,” he expressed concern.

When informed that DSE has been audited by the same firm for 36 years, he said, “How is this possible? This is malpractice. While there may be no legal bar, the issue is a matter of principle.”

He questioned why the issue did not come to the notice of the Bangladesh Securities and Exchange Commission (BSEC) or anyone.

According to DSE sources, in Thursday’s meeting, Managing Director ATM Tariquzzaman pointed out his observation regarding the auditor appointment.

He said A Qasem & Co has a long-standing association with DSE, which is against the fundamental principle of an auditor’s independence.

“So, it would be better to change the statutory auditor of DSE,” he suggested.

Taking the observation of the managing director, the audit and risk management committee of the DSE agreed with the managing director and suggested not re-appointing A Qasem & Co as statutory auditor.

The DSE committee has decided to appoint a new statutory auditor from the big four affiliated preferred audit firms of Bangladesh, following relevant acts, rules, regulations, and directives.

ATM Tariquzzaman told The Business Standard, “Times for the appointment of auditors with respect to listed companies are specified, with an emphasis on appointing different auditors to ensure financial transparency. However, DSE was audited by the same auditor, and nobody raised questions.”

“Being audited by the same auditor for an extended period is not in accordance with accounting standards. This practice undermines the auditor’s independence. When the issue was raised with the board to enhance financial clarity, the board agreed to change the auditor,” he added.

Ziaur Rahman, manager of A Qasem & Co, told TBS, “There is no legal barrier, but questions about ethics arise. However, this is not applicable to all auditors. We have served as auditors because DSE appointed us.”

Mohammad Rezaul Karim, spokesman for the BSEC, told TBS, “DSE operates according to its own laws and regulations. The company appoints auditors in compliance with the law. The commission can investigate whether the appointment of auditors is legal or not.”

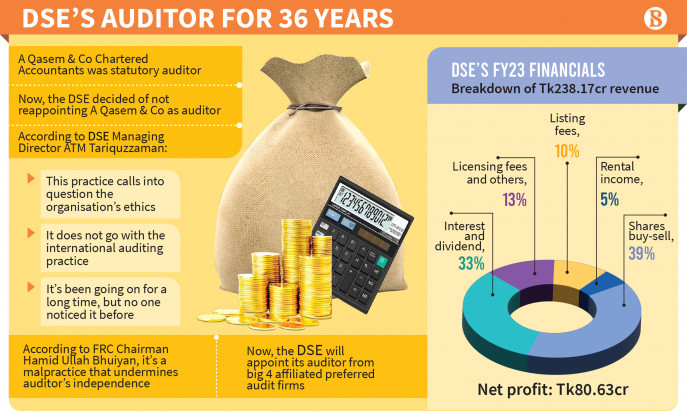

The DSE has witnessed a significant fall in revenue and profit in fiscal 2022-23 owing to stock market volatility and lower share transactions amid floor prices.

According to its financials, in FY23, revenue fell by 25% to TK238 crore, which is the lowest since fiscal 2019-20.

Its net profit after tax declined to Tk80 crore, 35% lower than the previous fiscal year.

As profit fell, the DSE board has recommended a 4% cash dividend for its shareholders for FY23.

In the previous fiscal year, it had paid a 6% cash dividend to its shareholders.

Source: tbsnews.net

Keep updated, follow The Business Standard’s Google news channel

Keep updated, follow The Business Standard’s Google news channel