The financial health of non-bank financial institutions (NBFIs) has been weakening, as an increase in the cost of funds has led to profit erosion.

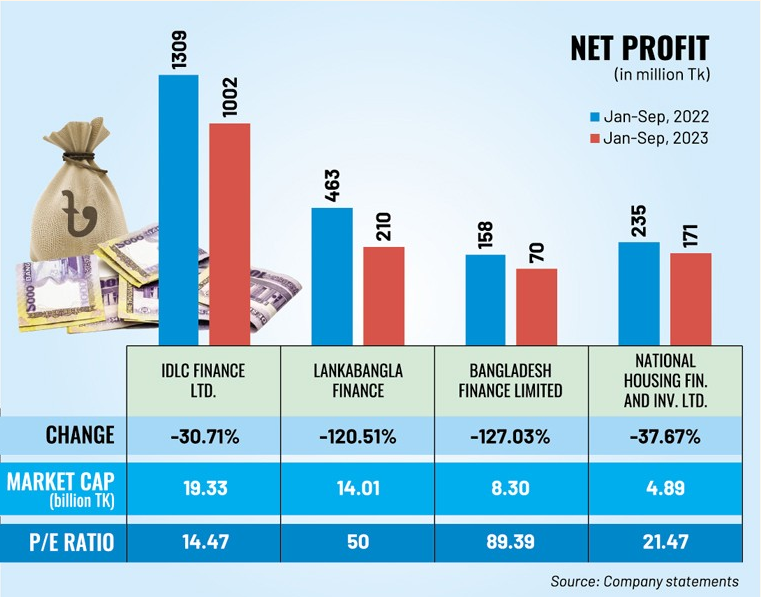

All four NBFIs, which disclosed on Monday un-audited earnings for the nine months to September this year, saw a sharp year-on-year decline in profit.

Apart from higher cost of funds, the depressed stock market squeezed the income opportunity of the financial institutions.

One of the biggest financial institutions of the country, with Tk 19.33 billion market value, IDLC Finance showed profit down 31 per cent in the nine months to September this year, compared to the same period last year.

According to a stock exchange filing, the major reasons behind the decline were a drop in the net interest income, shrinking investment income, and a fall in exchange and brokerage commissions.

"2023 has been a peculiar year. Usually, when the money market performs well, the stock market falls, and vice versa. But this year both the money market and the stock market have not been doing well," said Masud Karim Majumder, chief financial officer of IDLC Finance.

"Though the lending rate has been raised, we are yet to get any benefit out of it," he said.

According to the Bangladesh Bank law, NBFIs or any financial institutions are unable to lift the interest rate right away for old clients. They have to wait at least six months before applying new interest rates to old accounts.

On the other hand, most depositors keep money for terms as short as three months.

"We had to increase our deposit rates. That’s why our cost has escalated," added Mr Majumder.

LankaBangla Finance’s profit tumbled 121 percent in the first nine months of this year, compared to the corresponding period last year.

In an earnings note, it said the EPS (earnings per share) fell mainly due to the lending rate cap (before July), higher provision against loans and increased borrowing cost during the period.

However, cash flow rose as the company received higher deposits and gained higher income from investments during the period, compared to a year earlier.

Bangladesh Finance experienced higher profit erosion year-on-year than IDLC and LankaBangla Finance at 127% in the nine months to September.

Income was wiped out mainly by lower net interest income and lower earnings from investments in securities, the company said.

National Housing Finance and Investment gained a 38 per cent less profit in the nine months through September, compared to the same period last year.

Cash flow improved year-on-year in the third quarter ended in September due to a squeeze in the disbursement of loans and advances, the company said.

Mr Majumder said he was hopeful of things improving in the months to come.

"We will get the benefit [of interest rate hikes] from the next quarter as we will be able to raise interest rates on old accounts. We also believe that after the general election the overall situation will improve. Profitability will increase."Source: The financial express