Most of the listed multinational companies operating in the country witnessed higher profits and sales year-on-year in the nine months through September this year despite persistent economic challenges and inflationary pressures.

Brand image and quality of products empowered them to withstand the price hikes of raw materials and energy by passing the additional cost burden to consumers, market operators said.

Besides, managerial efficiency and good governance helped them earn more.

Thirteen multinational companies listed in the stock market account for more than 15 per cent of the total asset value of the Dhaka Stock Exchange.

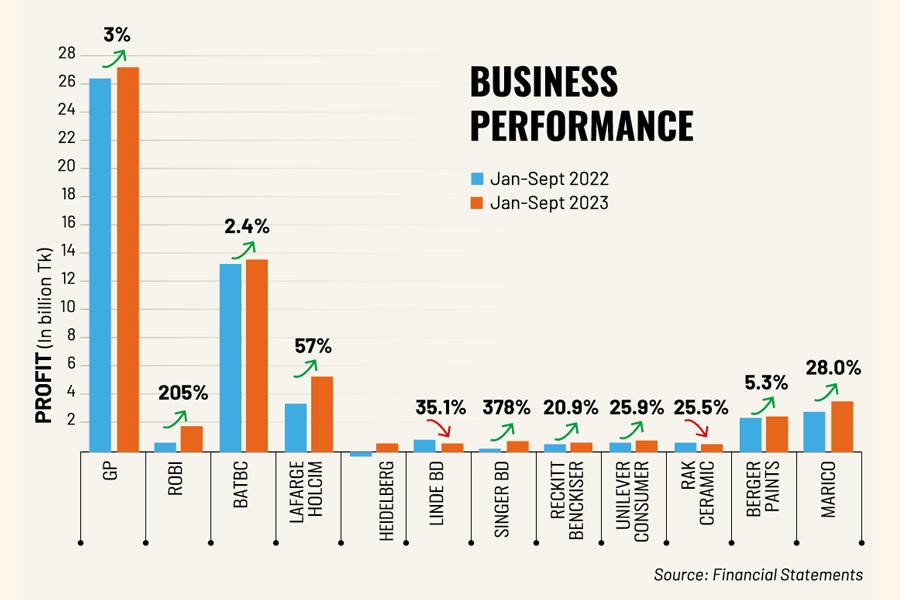

Except for Bata, earnings of 10 out of 12 companies that have published their financial reports rose between 2.4 per cent and 378 per cent year-on-year in January-September this year.

The 12 companies altogether logged about Tk 56.70 billion in profit in the nine months through September this year, 12 per cent higher than the same period a year before.

Their collective sales grew about 10 per cent to Tk 356.72 billion during the period under review, according to their unaudited financial statements.

Of those, consumer goods manufacturers saw the demand for their products remain almost stagnant. Still, manufacturers made higher profits, riding on price hikes.

On the other hand, cement makers, tobacco and telecom operators recorded higher sales revenue.

However, tiles manufacturer RAK Ceramics and oxygen producer Linde Bangladesh continued to see their revenue and profit fall for the past three quarters, owing to energy price hikes and increased input costs.

Singer Bangladesh came back strongly as the multinational electronic and home appliance maker’s profit more than tripled in the nine months, driven by two major festival sales.

Singer saw the highest profit surge at 378 per cent year-on-year in the nine months, as the company increased prices of all products.

Cement maker LafargeHolcim’s profit jumped 57 per cent to Tk 5.21 billion during the period, thanks to increased sales of aggregates and cement price hike.

Diverse product portfolio, digital footprint, strong marketing channels and aggregates business played a significant role behind the growth, said Iqbal Chowdhury, chief executive officer of LafargeHolcim Bangladesh.

Industry insiders say LafargeHolcim has a unique edge in business as it depends on its own source of raw material – limestone, which is transported from mines in Meghalaya to its factory in Chhatak, Sylhet by a conveyor belt.

That allows the company to avoid freight charges and escape

international raw material market volatility, two major factors that had shrunk the profit margins of its competitors.

Another multinational cement maker, Heidelberg that markets products with the brand name of Scan Cement also rebounded strongly in January-September this year after enduring losses in the same period a year before. The recovery was supported by higher sales price.

The German-based cement manufacturer recorded a profit of Tk 500 million in the nine months to September this year, as opposed to a loss of Tk 240 million in the same period a year before.

Grameenphone, the country’s leading mobile phone operator, registered 3 per cent higher profit to Tk 27.20 billion in January-September, the highest income among all listed multinational companies, driven by a boost to data revenue.

“Our effort in network expansion and investment, transforming the user experience, has strengthened our position as the number one network in the country,” said Yasir Azman, chief executive officer of

Grameenphone.

Robi Axiata, the country’s second-largest mobile operator, saw a remarkable 203 per cent escalation of profit in the nine months, on increased data revenue and reduced expenses in foreign currency transactions.

“We have invested continuously in network expansion and brought about changes in our sales and distribution,” said Mohammed Shahedul Alam, chief corporate officer of Robi Axiata.

British American Tobacco (BAT) Bangladesh witnessed a slowdown in its profit growth in the first nine months of 2023 mainly due to higher raw material prices and operating costs.

The tobacco market leader’s net profit grew 2.4 per cent while its net revenue after deduction of supplementary duty and value added tax (VAT) rose 10 per cent in the nine months.

Higher production costs, soaring operating expenses and increased tax payments have impacted the earnings growth, the company said.

Reckitt Benckiser has reported a 21 per cent higher profit

year-on-year for the period, as there was a jump in revenue and finance income and a reduction in marketing and operating expenses.

Unilever Consumer Care reported around 26 per cent profit growth in January-September this year despite a 6 per cent revenue drop as Horlicks maker managed to cut 38 per cent operating expenses.

Despite having a decline in revenue earnings, Berger Paints somehow managed to secure a marginal year-on-year growth in profit in the nine months.

Ms Rupali Chowdhury, managing director of Berger Paints, said foreign exchange loss was much higher this year compared to the previous year.

“Our company somehow was able to make a marginal growth in profit amid adverse impacts created by a decline in the demands for [our] products and currency devaluation,” Ms Chowdhury said.

Marico’s profit grew at a higher pace than revenue, as the consumer goods manufacturer successfully reduced the cost of sales and elevated finance income.

Marico recovered from last year’s negative net finance income and posted gains this year.

Meanwhile, Linde’s profit nosedived 35 per cent year-on-year to Tk 0.48 billion in January-September mainly due to lower sales and a sharp devaluation of the local currency against the US dollar.

Linde did good business in 2021, particularly in the medical segment, as the need for oxygen shot up to help Covid patients dealing with breathing distress in hospitals.

RAK Ceramics, the country’s largest and renowned tiles and sanitary ware maker’s profit dropped 25 per cent, owing to energy price hikes and increased production costs.

MNCs / Multinational companies / earnings

Source: https://thefinancialexpress.com.bd/stock/bangladesh/stocks-down-at-opening-amid-nation-wide-blockade