The financial account balance, which includes foreign direct investment, short-, medium-, and long-term loans, and trade credits, continued to widen in the negative territory, driven by a decline in foreign loans and aid, as well as a reduction in trade credits.

The central bank data, released on Thursday, reveals that the country’s financial account balance dipped into the negative, reaching nearly $4 billion by the end of September. This is a stark contrast to the positive balance of $839 million recorded a year ago and the negative balance of $3.25 billion in August this year.

A central bank official told The Business Standard that the decline in foreign loans and investments is exerting downward pressure on the financial account.

International rating agencies have downgraded Bangladesh’s ratings in recent months, eroding foreign investor confidence as they perceive the country to have become riskier than before.

The private sector has attracted millions of dollars in foreign loans over the past several years. However, the trend has shifted due to the surge in interest rates, which have soared from 0.5% two years ago to the current rate of 5.5%. Also, the continuous devaluation of the taka against the dollar has made traders more risk-averse when taking out new loans.

Central bank data shows that the dollar was sold from reserves at Tk96 in October last year and Tk111 in early November this year.

This devaluation of the taka has significantly increased the cost of repaying foreign loans.

Infographic: TBS

Economists said the increase in our trade-credit deficit is one of the major reasons for the widening financial account deficit. The trade-credit deficit was $3.77 billion at the end of the first quarter of this fiscal year, compared to $904 million in the same period last fiscal year.

Zahid Hussain, former economist of the World Bank’s Dhaka office, told TBS, “If we receive $80 in payment for exports of $100, the remaining $20 is considered a trade credit deficit. Many minor factors also contribute to the trade credit deficit.”

A central bank official said exporters have some time to repatriate export proceeds, which is why there is a gap between actual export value and payment. Additionally, buyers do not always pay the full amount, and exporters often have to give discounts. However, it is also true that export payments are now taking longer than usual to receive.

Bangladesh’s foreign exchange reserves stood at $21.15 billion at the end of September. After clearing the September-October import bills of $1.21 billion with the Asian Clearing Union (ACU) next Monday, the reserves will stand at $19.29 billion, according to BPM6 calculation. The deficit in the financial account is keeping the reserves under pressure.

Trade deficit, current account balance on the mend

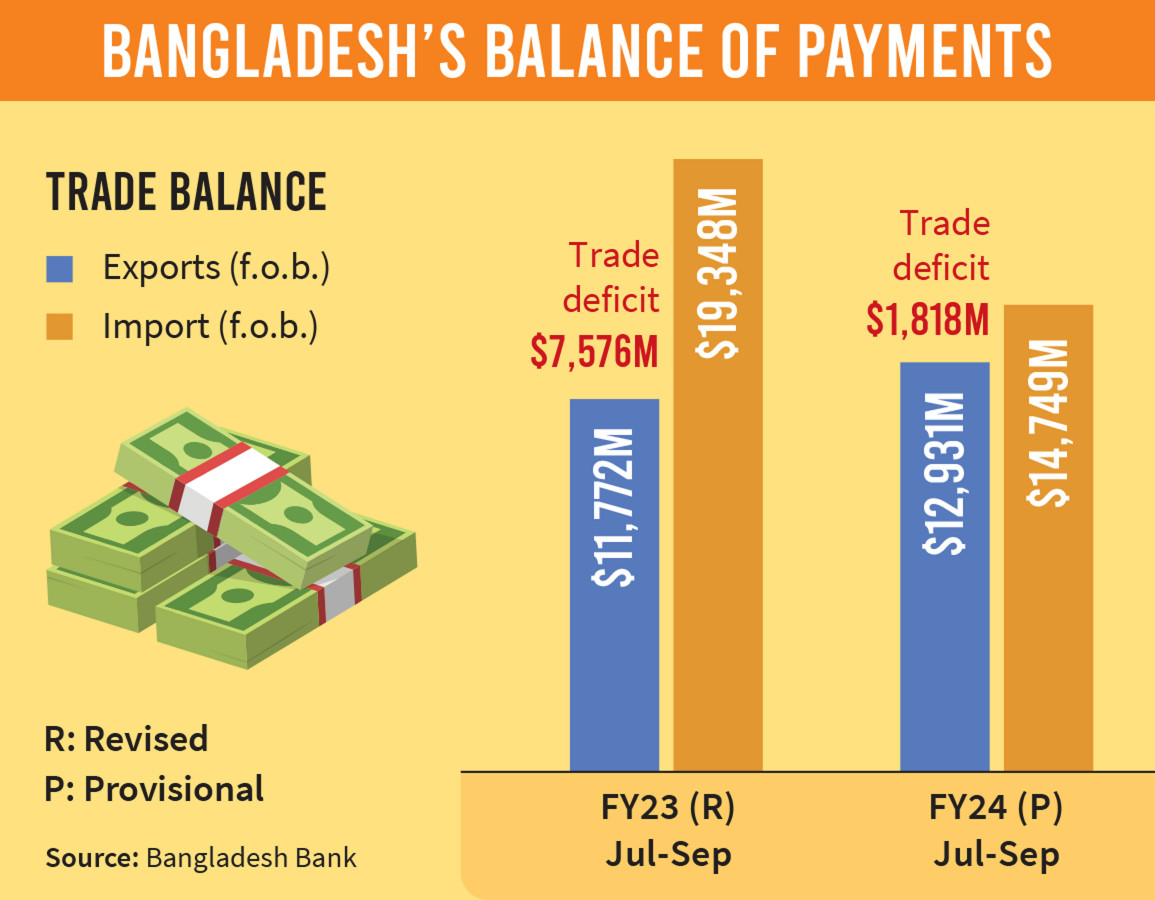

Bangladesh’s deficit in trade balance – the difference between exports and imports – narrowed significantly compared to the previous fiscal, thanks to a decline in imports.

According to Bangladesh Bank data, the trade deficit stood at $1.82 billion at the end of the July-September period of FY24, which was $1.02 billion at the end of the July-August period. However, the trade deficit was much wider at $7.58 billion at the end of July-September of the previous financial year.

Bangladesh’s current account balance has improved significantly, with a surplus of $892 million in July-September of FY24, compared to a deficit of $3.68 billion in the same period of the previous year.

“Remittances dropped in September, but the current account balance has remained positive and the trade deficit has narrowed, mainly due to a decrease in imports,” said Zahid Hussain.

“The central bank created a current account surplus by slowing the economy through import controls,” the economist said, adding that imports should be increased to promote economic growth.

Central bank data shows that remittances fell by 13.34%, or $750 million, in the July-September period of FY24 compared to the same period last year. During the same period, imports decreased by 23.77%, or $4.6 billion, while exports increased by 9.85%.

The current account balance is the primary source of a country to make foreign payments. When a country’s current account balance turns negative, it first uses its financial account to make foreign payments. If the financial account also becomes negative, the country then uses its reserves to make foreign payments.

The overall balance of payments deficit narrowed to $2.85 billion at the end of September, down $350 million from the same period in the previous fiscal year.

Zahid Hussain said that the overall balance of payments has slightly improved, driven by a current account surplus. However, the widening financial account deficit is a concern.

He said Bangladesh’s managed floating rate of the dollar between 2003 and 2022 was a model for many countries, but the situation has changed.

The economist believes that the dollar rate should now be based on market forces. However, if a market-based rate is not possible in the short term, corridors should be established around the dollar rate to create a level playing field.

Central bank data also shows that the balance of payments had a net positive error and omissions of $140 million in the first three months of FY24, compared to a net negative error and omissions of $512 million in the same period of FY23.

Zahid Hussain said, “Positive error and omissions mean an unaccounted inflow of dollars. It is not possible to detect how the dollars arrived but the Bangladesh Bank will be able to tell whether it was an inflow or not.”

Trade Deficit / Balance of Payments / Bangladesh

Source: https://www.tbsnews.net/economy/financial-account-deficit-widens-further-september-732158