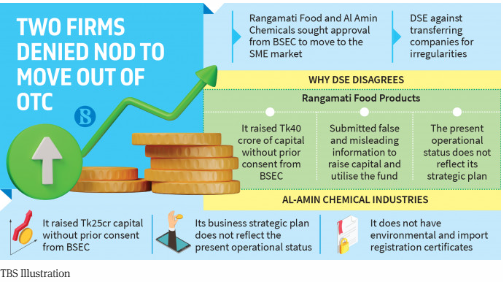

The Dhaka Stock Exchange has decided not to transfer Al-Amin Chemical Industries and Rangamati Food Product to the SME market from the over the counter (OTC) market as “they violated securities rules”.

In a letter sent to the companies on Thursday, the country’s premier bourse said, “The DSE management is not in a position to transfer their shares to the SME market.”

The Dhaka bourse mentioned in its letter that the companies raised capital without prior consent from the Bangladesh Securities and Exchange Commission (BSEC), and their operational status does not reflect their strategic plans.

The letter further mentioned that the DSE inspection team visited the head offices and factory premises of the companies and submitted its reports based on the findings to the commission.

Speaking to The Business Standard last month, Munshi Shofiuddin, managing director of Al-Amin Chemicals, said, “In March this year, the commission, in a letter, instructed us that we don’t need prior approval to raise capital as we are not listed on the bourses. So, the company raised capital through private placement without regulatory approval.”

Asad Chowdhury, managing director of Rangamati Food Products, told TBS, “The commission had earlier said that we don’t need to secure approval to raise capital if it is needed. The commission had directed us to secure post-facto approval.”

He claimed that their factory is in operation and has launched around 72 products.

What the DSE letter says

The stock exchange said Al-Amin Chemical Industries had raised an additional Tk25 crore as paid-up capital without the commission’s approval, which is contravening securities laws.

The strategic business plan of the company does not reflect the present operational status, said the stock exchange in the letter.

The DSE also said the company has no environmental certificate or import registration certificate.

Al-Amin Chemical was listed on the bourses in 2002.

However, in 2009, it was shifted to the OTC market and has remained there since.

Now, the company seeks to shift to the SME platform of the stock exchanges.

For that, the company has to comply with the BSEC’s time-to-time instructions about raising capital, collection of share money deposits, proper issuance of securities, and utilisation of the funds.

In May 2022, cricketer Shakib Al Hasan, through his firms Monarch Mart and Monarch Express, and associates acquired 48.175% shares of Al-Amin Chemical’s sponsor-directors, out of which Managing Director Munshi Shofiuddin bought 8.175% shares.

Al-Amin Chemical Industries was incorporated in 1990. Its factory is located in the Bangladesh Small and Cottage Industries Corporation (BSCIC) area in Kanaipur, Faridpur. It produces chemical fertiliser, battery water, drinking water, and softeners.

Rangamati Food Products

Rangamati Food Products Ltd wants to return to the SME market from OTC.

The company used to supply canned fish, meat, jam, and jelly to big buyers such as security forces and airlines, but it was not in operation for long.

The stock exchange on Thursday said in the letter it had raised Tk40 crore as paid-up capital without the commission’s approval.

The company has submitted false and misleading information while raising capital as well as utilising funds, said the DSE letter.

The present operational status does not reflect the business strategic plan of the company.

A decade ago, Rangamati Food was sent to the OTC board of the Dhaka Stock Exchange due to non-compliance with regulatory orders to transform its shares into electronic ones from paper shares.

source: tbsnews.net