stockmarket sharebazar pujibazar investment Bsec dse cse

Parvez Ali was befuddled when he discovered that his assets in post-merger Far Chemical Industries Limited and R.N. Spinning Mills lost value by 20 per cent and 47 per cent on Sunday.

He had 300 shares of pre-merger Far Chemical, which he had bought at the floor price of Tk 10.6 each share. So, his stake in the company was worth Tk 3,180 until the merger on October 31.

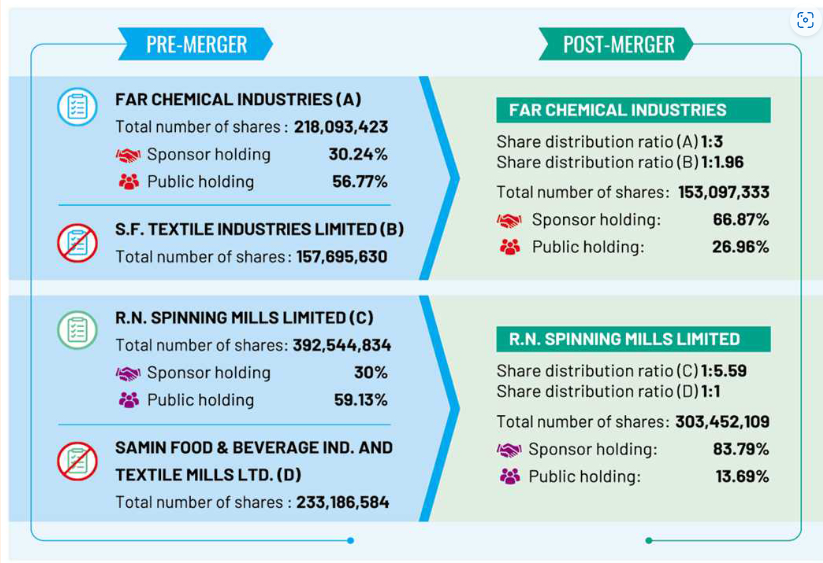

As the listed Far Chemical absorbed the assets and liabilities of non-listed S.F. Textile Industries, pre-merger shareholders of the listed company received shares of the new entity at a ratio of 1:3.

Hence, Ali got 100 shares in exchange for 300 shares.

According to the Sunday’s trading price of Tk 25.4 each share, the market value of Ali’s stake in the new entity stood at Tk 2,540, reduced by 20.13 per cent.

In a similar fashion, Ali’s 200 shares of R.N. Spinning Mills had been converted into 35 shares [at the ratio of 1: 5.59] of the entity that came into being after the amalgamation of the listed R.N. Spinning and non-listed Samin Food & Beverage Ind. and Textile Mills.

Shares of R.N spinning after the merger traded at Tk 18.9 each on the Dhaka Stock Exchange. Therefore, Ali’s holdings in R.N spinning are valued at Tk 662, almost half his pre-merger asset price.

Market analysts suspect manipulation in the financial statements submitted to the stock market regulator ahead of the mergers. They also alleged a violation of the court order linked to the permission for the mergers.

The High Court had issued an order asking the authority to set the share distribution ration based on a revision of the companies’ accounts.

Meanwhile, investors, having seen a sharp decline in the market price of the stocks, rushed to the regulatory bodies to communicate their concern.

In response to which, the Bangladesh Securities and Exchange Commission (BSEC) re-fixed the floor price of the two companies.

The new floor price will be the average of closing prices in the four trading sessions to Monday, as per a directive issued on Monday. Therefore, the new floor price of Far Chemical is Tk 28.2 and of R.N. Spinning Tk 20.9.

The move was made, as BSEC Chairman Shibli Rubayat Ul Islam said in the directive, in the interest of investors and the market.

After the merger, the share of the general public in Far Chemical has been slashed to 27 per cent from 56.77 per cent. Retail investors’ stake in R.N. Spinning dropped too from 59.13 percent to a mere 13.69 percent.

Interestingly, both Far Chemical and R.N. Spinning Mills are owned by the same group of people. Both the companies merged with their sister concerns.

Mr. Abdul Kader Faruk, chairman of the F.A.R Group, had been accused of siphoning money from the IPO fund of Ring Shine Textiles, according to an inquiry report of the BSEC.

The correspondent could not reach representatives of Far Chemical Industries and R.N. Spinning despite repeated attempts over the phone for comments.

Share distribution pre-and post-merger

Before merger, Far Chemical had more than 218 million shares, which were converted into a little over 72 million shares of the post-merger entity.

The company has also issued about 80 million shares against the equity of S.F. Textile Industries. The post-merger entity has over 153 million shares in total.

R.N. Spinning Mills before the amalgamation had over 392 million shares, which were exchanged for 70 million shares of the new entity.

It has released another 233 million shares to the owners of Samin Food & Beverage. So, the total number of equity shares of the post-merger entity comes around 303 million.

An expert in the field, who has been closely watching the merger process, told the FE that there had been manipulation in different phases. He sought anonymity to avoid any reprisal.

Not only the companies but also some people in the regulatory body had been involved in the wrongdoing, he said.

"These people are the reasons why we are unable to protect investors in Bangladesh."

Several other sources also said relevant departments of the BSEC had been against the approval of the mergers.

What led to the mergers?

Far Chemical that produces textile dyeing chemical products suffered losses for the three financial years through FY23. Its cumulative losses amount to Tk 362 million.

RN Spinning has been counting losses since FY19 as a fire incident forced the company to shut down its operation in April 2019. It suffered a loss of Tk 6.55 billion in total in the five years through June this year.

A merger is an agreement that combines two existing companies into one. It is meant to gain market share, reduce cost of operations, expand to new territories, grow revenues, and increase profits.

Before merger, a careful analysis is needed about the transferor company.

A transferor company is a business entity that transfers its assets, liabilities, and obligations to another company as part of the merger or acquisition.

In the aforementioned mergers, S.F. Textile Industries and Samin Food & Beverage are transferor companies.

A transferor company’s business potential is unknown to the public. So, it is not possible to determine if the huge price paid by the existing shareholders would have any positive outcome.

In both the cases, sponsors and directors are likely to benefit from the mergers, while retail investors will suffer.

#Financial Express